From 80 to 40: A Strategic Approach to Patent Evaluation

This post continues our strategic patent evaluation clues—building on the framework outlined in our previous article, where we narrowed down over 800 ophthalmic diagnostic patents to a shortlist of 80.

While the 80 patents identified were technically sound and aligned with commercial and product development goals, our client needed an even more focused list for actionable decisions around acquisition, in-licensing, or monitoring.

That’s where this next phase comes in: introducing a solution-function-driven framework to reduce the shortlist from 80 to 40 highly strategic patents.

The Case for a Complementary Framework

Our earlier selection focused on clarity and depth of technical disclosures, business alignment, and commercialization readiness. It gave us a well-structured pool of patents with high-level relevance.

However, further narrowing required a different lens—one that could highlight functional innovation beyond the diagnostic core. Many patents disclosed similar diagnostic capabilities. But not all were equally valuable when it came to usability, clinical integration, or system-level advantages.

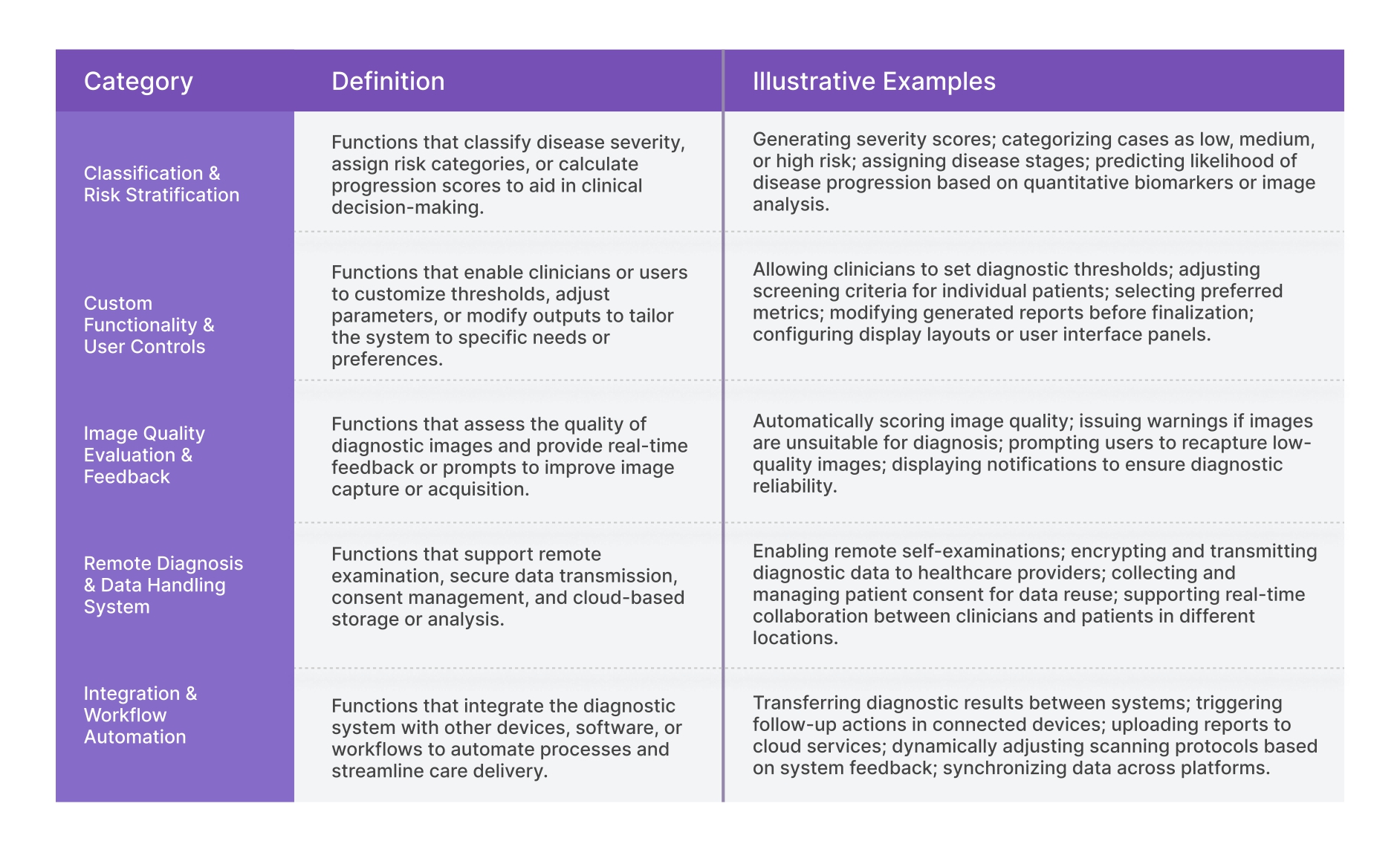

That led us to define a new complementary layer of classification based on what we call "solution functions"—value-adding features that enhance how a diagnostic system operates, connects, or delivers insights.

Curious Clue #2

Solution Functions Reveal Hidden Strategic Value Beyond Core Invention

In crowded technology domains, patents often appear similar at first glance — but the presence of clear, well-defined solution functions can transform a seemingly ordinary disclosure into a strategically valuable asset. These functions might include any capabilities that extend the invention’s practical application, improve its ease of use, or enhance its integration into broader processes or systems.Functional Categories in Diagnostic AI Systems

The following table defines the solution functions we used to classify the remaining 80 patents. These go beyond diagnostic accuracy to include features that improve integration, automation, customization, or decision support.

Applying the Framework: From 80 to 40

Once these solution functions were defined, we used them as an additional lens to classify the remaining patents into two major categories:

| Category | Description |

|---|---|

| #1: Diagnostic-Only Systems | Systems primarily focused on diagnosis, characterized by improved diagnostic accuracy, novel methods, or use of specific biomarkers. |

| #2: Diagnostic Systems with Additional Solution Functions | Systems that go further—providing additional value through integration, automation, personalization, and actionable treatment or referral recommendations. |

This new classification helped us prioritize patents that not only described how to detect or diagnose disease but also how to act upon the results or integrate with broader clinical workflows. These functional additions greatly improve a patent's value from a commercialization and implementation perspective.

By focusing on patents that disclosed at least one of the six solution functions—and weighting those that offered multiple—we were able to reduce the list from 80 to 40. These 40 patents now represent the most strategically actionable assets in the portfolio.

Why This Matters

This step matters because, in many emerging fields—like AI-driven diagnostics—technical invention alone isn’t enough. What differentiates high-value patents is how well they support real-world application, clinical usability, and product strategy alignment.

By evaluating patents based on solution function disclosures, we surfaced patents that were:

- Better positioned for licensing or integration

- More relevant to future product upgrades

- Capable of strengthening clinical partnerships or collaborations

- Aligned with regulatory and operational goals

The outcome wasn’t just a shorter list—it was a smarter list.

Conclusion: From Discovery to Decision

With a now tightly focused list of 40 strategic patents, our client is well-positioned to move forward with confidence—whether in pursuing in-licensing, acquisition, or targeted monitoring.

These remaining patents demonstrated strong alignment with the client’s product vision, business objectives, and innovation goals—positioning them as the most promising candidates for acquisition, in-licensing, or monitoring.

In our next post, we’ll explore the final step in this process: how we ranked these 40 patents based on new parameters like citation landscape, claim scope, jurisdictional strength, and potential FTO implications—moving from shortlisting to decision-making.

If you haven’t yet read the first part of this series, you can find it here: