From 800 to 80: A Strategic Approach to Patent Evaluation

When you're presented with hundreds of patents and asked to pinpoint the few that truly matter to your business — whether for acquisition, in-licensing, or monitoring — a clear, objective-driven evaluation strategy becomes essential. The question isn’t just which patents are innovative, but which combine clarity, technical depth, and commercial potential to align with your technical goals, business interests, and long-term vision.

This blog introduces a structured approach to help you systematically narrow down large patent datasets to a shortlist of strategically relevant, high-value patents. We illustrate this through a real-world case study in ophthalmic diagnostics, where we reduced 800 patents to 80 highly relevant ones through targeted evaluation.

A General Framework for Patent Evaluation

Start with Strategic Alignment - When faced with a large patent set, the first and most important step is to define the strategic lens through which you'll assess each asset. This means:

- Defining your product development goals — what specific functionalities, technical implementations, or know-how do you aim to build or enhance through patent acquisition?

- Understanding how each patent aligns with these goals — do they describe value-added solution functions, provide detailed implementation steps, or represent commercially usable innovation versus being abstract or overly generic?

- Considering the time-to-market relevance — is the technology disclosed mature enough to support your immediate roadmap or better suited for long-term innovation?

- Assessing freedom-to-operate implications — can this patent help reduce legal risk or secure a clearer path for commercialization?

- Mapping competitor positioning — is the patent already cited or owned by a market leader or disruptive player?

- Reviewing geographic coverage — does it offer protection in your key business regions (e.g., US, EU, JP)?

- Evaluating licensing or monetization potential — does it offer reuse beyond internal application, potentially driving licensing value?

- Checking synergy with existing IP — can it reinforce or expand your current patent portfolio?

- Measuring ease of integration — is the disclosed system implementable without major changes or dependencies?

Once this critical judgment is made, the next step is to apply a structured relevance model to categorize and rank the patents effectively based on how well they serve the strategic priorities defined earlier.

Curious Clue #1

“Patent portfolios can be strategically ranked on a relevance spectrum from highly relevant—defined by clear claims, thorough technical disclosure, commercial potential, and strategic alignment—to low relevance, where patents lack clarity, differentiation, or connection to core business objectives."Tiered Relevance Model

To streamline evaluation and prioritize decisions, we use a relevance ranking model grounded in three core dimensions, selectively drawn from the broader nine-point strategic evaluation framework introduced earlier:

- Clarity of technical and functional disclosures — Directly supports your product development goals and shows how well the know-how is conveyed (Point-1)

- Alignment with business strategy — Ensures the patent delivers meaningful solution functions and advances your specific innovation objectives (Point-2)

- Readiness for commercialization, integration, or licensing — Reflects its short- or long-term applicability and how seamlessly it fits into your existing or envisioned product ecosystem (Point-3 and Point-9)

These three were chosen because they most directly influence whether a patent can deliver strategic advantage by supporting product development, aligning with business priorities, and enabling practical commercialization.

Relevance Ranking Overview

| Rank | Description | Key Indicators |

|---|---|---|

| A: Strategic | Technically sound, commercially relevant, and strategically aligned | Detailed technical disclosure, clear claims, real-world use case, alignment with core strategy, potential for licensing or differentiation |

| B: Relevant | Conceptually strong but lacking technical depth or clarity in claims | Mentions key functions or concepts; incomplete or early-stage development; unclear claim structure |

| C: Peripheral | Generic, redundant, or not clearly differentiated | Overlaps with known methods, minimal innovation, lacks specificity or strategic differentiation |

| D: None | Out of scope or irrelevant to the domain of interest | Falls outside the technology or business focus; unrelated use cases or industries |

| E: Supportive | Useful for integration or support, but not core IP | General enablers, supporting tools, or ancillary features that enhance adoption or usability without defining the main inventive contribution |

This general framework ensures that no valuable patent is missed, and that every selection is defensible from both a business and technical perspective.

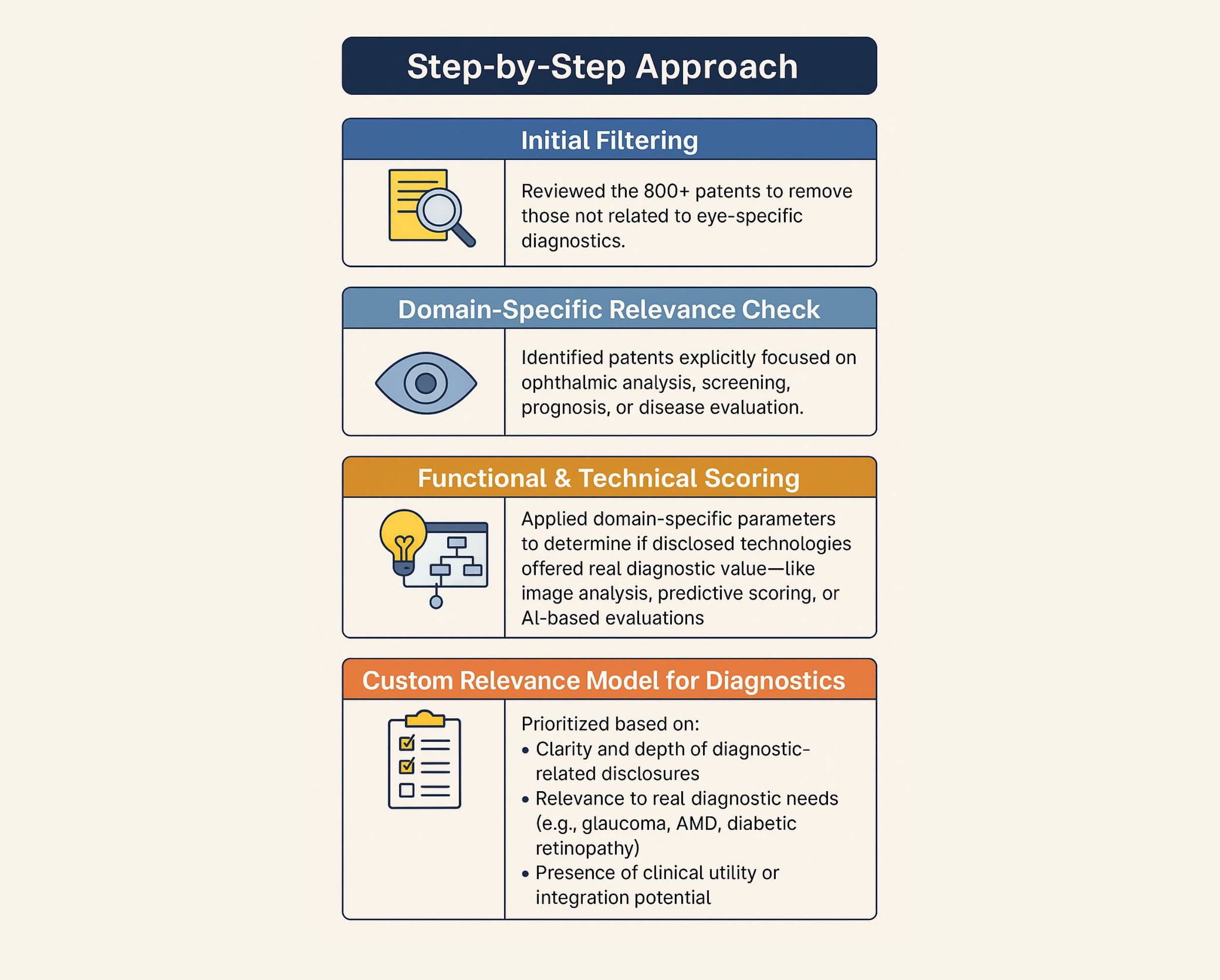

Applying the Framework to a Real-World Case: Ophthalmic Diagnostics Portfolio Evaluation

Once the general framework had been defined, we applied it to a live project focused on identifying high-value patents in ophthalmic analysis and diagnostics. This included patents disclosing technologies for screening, monitoring, prognosis, and decision-support systems tied to eye-related health conditions.

With over 800+ patents on the table, our job was to identify a high-value subset that supported clinical use, advanced diagnostic capability, or meaningful integration potential.

Final Scoring Framework for Ophthalmic Diagnostics

| Rank | Description | Key Indicators |

|---|---|---|

| A: Strategic | High Usability or Strategic Value | Detailed technical disclosure, AI workflow clarity, interpretable output, real-world applicability |

| B: Relevant | Early-Stage but Conceptually Strong | Mentions AI or functionality but lacks architectural depth or clarity in claims |

| C: Peripheral | Minimal Innovation or Broad Generalization | Lacks distinctiveness, focuses on non-strategic hardware or abstract methods |

| D: None | Irrelevant to Ophthalmic Context | No relevance to diagnostic domain or clinical utility |

| E: Supportive | Indirectly Useful, Non-Core | UI, integration methods, or backend infrastructure with supportive role |

Each patent was then scored and grouped using the above tiered relevance framework — designed to highlight not only technically interesting patents, but those with high applicability to product development and clinical implementation in ophthalmology.

A few exemplary Patents those fits within the defined tiered relevance framework were:

Strategic Patent:

US20250031957 — Tracks user-specific metrics and generates real-time alerts, with both clinical and consumer applications

Relevant Patent:

US11747627 — AR/VR-based diagnostic display; promising but lacking clarity on training methodology

Peripheral or Supportive Patent:

US20230181030 — Optical lens customization for vision correction; unrelated to diagnostics

Key Challenges Faced

- Ambiguous Claims: Required careful interpretation beyond abstract summaries

- Overlapping Categories: Multi-purpose patents made classification harder

- Scope vs. Specificity: Distinguishing full systems from isolated modules was essential to mark difference between supportive and peripheral patents

Why This Matters

This method ensured that the client didn't just get a trimmed patent list, but a strategically aligned, commercially viable subset of high-impact patents worth acquiring, licensing, or monitoring.

Manual patent evaluation takes time, but when combined with structured strategy and domain insight, it becomes a powerful tool for IP professionals. In fast-evolving sectors like AI-driven healthcare, this approach can help surface truly game-changing innovations.

If you’re in IP strategy, product innovation, or M&A due diligence, incorporating structured manual evaluation into your process can help you make smarter, more confident decisions.

The goal is not just to identify patents that are technically sound, but those that can support:

- Commercialization

- De-risk development

- Reinforce strategic IP positioning

Conclusion

By applying this strategic evaluation framework and tiered relevance model, we successfully narrowed down an initial dataset of over 800 patents to a curated list of just 80.

These remaining patents demonstrated strong alignment with the client’s product vision, business objectives, and innovation goals—positioning them as the most promising candidates for acquisition, in-licensing, or monitoring.

Interested in more? Don’t miss the second part of this series — read it here: